The Ultimate Contrarian Investment

What if there were an asset, just as ancient as gold, with a multitude of contemporary applications, guaranteeing its relevance in present times and the foreseeable future?

An asset that’s played foil to gold for millennia, while holding its value in times of uncertainty…

An asset so fundamental to our daily lives, that we couldn’t live without it…

Known for its exceptional conductivity, thermal abilities, chemical stability, sterilizing effects and light-reflecting beauty…

Given its essential role in electronics and automotive industries to its significance in photography, jewelry, and even medical applications, I believe this asset is the backbone to our economy.

Investors like Warren Buffett, Rick Rule, Jim Rickards, to name a few have gone “all-in” on this asset.

So let’s jump in where I’ll tell you all about it, and even name my #1 stock pick of a company that specializes in this asset…

Believe it or not, this hidden gem has a myriad of applications within a multitude of diverse industries. From electronics and medicine to catalysis and even the arts, this asset has revealed its impressive versatility time after time. In the world of telecommunications, this asset delivers excellent conductivity and resistance to tarnish, making it an integral part of our everyday devices. It brings energy-efficient solutions to our homes and businesses, with its use in solar panels and other renewable energy technologies. Furthermore, in the healthcare sector, it exhibits impressive antimicrobial properties that aid in wound healing and infection prevention. Indeed, it is humbling to realize the crucial roles this simple element plays in advance medical techniques and treatments.

However, the value of this asset isn’t limited to its practical applications. Over the last quarter-century, those who have backed this miracle investment have observed astronomical growth. From 1997 to 2022, this unsung hero has reported a cumulative return of over 338%. That’s right! An initial investment of $10,000 back then would have grown to a staggering $33,800 today. Unfazed by the ups and downs of the stock market, this asset has proved itself as a safe haven during times of financial turmoil, consistently delivering impressive returns year after year.

While this may sound too good to be true, all figures are based on verifiable historical data. In the words of Ken Rogoff, former chief economist at the International Monetary Fund (IMF), “An unalterable metallic asset such as this one is less subject to inflation risks and offers significant defensive attributes.”

So, are you ready to discover the name of this investment miracle?…

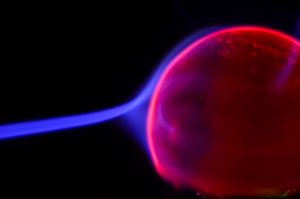

It isn’t a high-tech cryptocurrency or a complex financial instrument. It’s simpler and much more tangible. At this juncture, I’d like to introduce you to … Silver!

Precious Metal with Abundant Possibilities

In the current investment landscape, Silver often wears too many hats. Allow me to articulate different ways the average investor like you and I can delve into this investment opportunity.

- First up, purchasing Physical Silver. This could be bars, coins, bouillons and rounds (collectible silver).

- Want a direct connection to this metal’s extraction? Investing in Silver Mining Companies could be your thing.

- Yes, there’s an uncomplicated, liquid way to own a slice of a multitude of silver miners – through Silver Exchange-Traded Funds (ETFs).

- For those seeking a unique angle, Silver Royalty and Streaming companies present a fascinating alternative. They secure agreements to buy silver at a discount from partner miners and offer potential profit windfalls.

My #1 Silver Stock: Endeveavour Silver Corp (NYSE: EXK) $1.82

Endeavour Silver Corp is a mid-tier precious metals mining company that operates in Mexico and Chile. The company is primarily focused on the discovery, extraction, and processing of silver and gold. Endeavour Silver Corp has been known for its commitment to responsible mining, with a strong emphasis on providing sustainable benefits to the local communities where it operates.

Over the past few years, Endeavour Silver Corp has shown a steady performance in the mining industry. The company has been successful in maintaining a consistent silver production, which has contributed to its solid financial performance. In 2021, the company reported a production of 6.1 million ounces of silver and 58,790 ounces of gold. This was a significant increase from the previous year, demonstrating the company’s ability to scale its operations.

In terms of investment, Endeavour Silver Corp’s stock has shown a positive trend over the past 25 years. The company’s shares have appreciated significantly, providing a good return on investment for its shareholders. The company also has a good track record of paying dividends, which adds to the total return for its investors.

In conclusion, Endeavour Silver Corp presents an interesting investment opportunity for those interested in the silver mining industry. The company’s strong operational performance, robust financial health, and positive stock performance make it a potential candidate for investment.

Why I Hold Silver: A Personal Investment Thesis

Now, allow me a moment to share my personal engagement with Silver. I, like many of us, believe in the potential of tangible, historical sound commodities. There’s something reassuring about the heft of a silver coin, don’t you think?

But, why do I hold physical silver and invest in Silver?

“In times of macroeconomic uncertainty, silver tends to retain its value.”

– Andrew McOrmond, managing director at WallachBeth Capital

McOrmond’s statement essentially reveals my core investment thesis. I perceive silver as a hedge against the vibrant hues of economic upheaval. It’s a reserve of value, bearing the potential to appreciate significantly. More so, it’s one of those few rare assets that doesn’t rot, tarnish, or decay, retaining an inherent value independent of any external third-party liability.

Moreover, owning physical silver offers a sense of control. It’s mine, kept in my designated area, and isn’t exposed to potential hacking or network failures, unlike many modern investment types. However, this doesn’t mean I wholly shun alternate silver investments. Where physical silver presents storage and liquidity issues, miners, ETFs, and royalties provide ease and diversity, juxtaposing horse strengths.

To sum up, regardless of how anyone chooses to invest, Silver remains a testament to time-honored stability and presents potentially lucrative opportunities. My belief? Every wise investor should have a bit of silver in their portfolio… So, how about joining me on this rollercoaster ride of Silver investing? Let me know by emailing me here!