Harnessing clean energy is essential due to the global transition away from carbon emissions and toward clean, renewable energy resources. What’s so special about this “green wave,” though?

For one, there are plenty of alternative clean energy resources available to us, giving investors a variety of options. Secondly, it just so happens that the worldwide green hydrogen sector in particular is growing quickly. The hydrogen industry as a whole was valued at around $676 million as of last year and is on track to hit $7.3 billion by 2027. Expected to grow by 61% annually, that would bring a stunning total return of more than 1,000%. This should excite any investor who both embraces the clean energy transition and is looking for the next big investment.

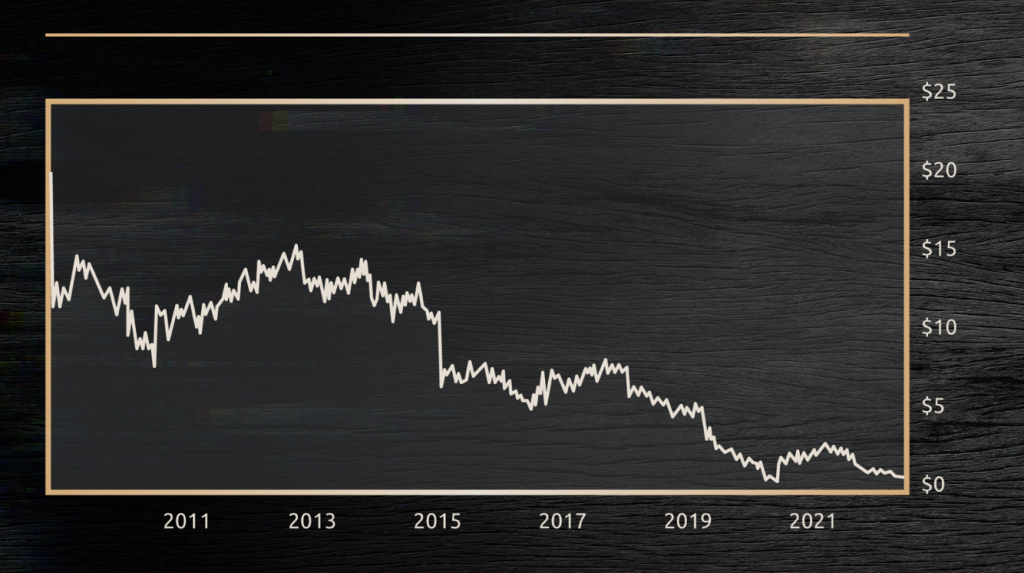

We want to see strong business metrics, growth, and upside potential (refer to the year-to-date graphic). A number of them pay dividends as well, which always makes for a happier shareholder. So, could this be a key to unlocking the future? Many of Wall Street’s best and brightest say yes, indeed.

I’ve found three green hydrogen stocks with massive potential, so let’s break them down:

New Fortress Energy Inc (NFE)

New Fortress Energy, Inc. (NFE) is an investment holding company that manages integrated hydrogen energy infrastructure. NFE invests in, constructs, and runs natural gas pipelines and provides logistical support for renewable energy technologies. Wesley Robert Edens created NFE on February 25th, 2014,

and its headquarters are in New York, NY. NFE’s stock is down by 33.14% YTD, trading at the very bottom of its existing 52-week range. With a cap of $5.82 billion and an $11.20 billion EV, NFE shows $2.44 billion in TTM revenue—at 51 cents per share—and it profited $106 million in the same period. NFE shows a solid

MRQ earnings report, with an analyst-forecast surprise on EPS by an 8.81% margin, and it displays YOY growth in revenue (+14.65%) and operating income (+59.02%). NFE has an annual 1.46% dividend yield, with a quarterly payout of 10 cents ($0.40/yr) per share on the back of its mammoth 693.88% payout ratio. With a 10-day average volume of 1.11 million shares, NFE has a median price target of $55.50, with a high of $61 and a low of $34; this implies a potential price upside of 95% at its median, 115% at its high point, and, even at its lowest point, a 20% jump. Analysts give NFE 9 buy ratings and 1 hold rating.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”NFE” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

Cummins Inc (CMI)

Cummins Inc. (CMI) is a global company that manufactures and services engines for natural gas and electric vehicles. CMI also offers emission solutions, A/C generators, and electrified power systems, including batteries, fuel cells, and hydrogen production. CMI sells its products to OEMs, distributors, and other customers worldwide. Established originally in 1919 as Cummins Engine Company and headquartered in Columbus, IN, CMI was renamed Cummins Inc. in 2001. CMI is down 10.84% YTD, nearing the bottom of its 52-week high-low. With a strong 0.90 beta, CMI’s market cap is $31.67 billion, and it has a P/E ratio of 12.6x, a forward (NTM) P/E ratio of 11.6x, a PEG figure of 1.32x, a P/S ratio of 1.05x, and a 27.94% ROE. CMI recently crushed analysts’ forecasts for EPS by 20.24% and revenue by 4.01%, with YOY growth in revenue (+32.39), net income (+89.0%), and EPS (+90.07%). CMI boasts a dividend that has grown each year for 14 years, currently with an annual yield of 2.91% and a $1.57 ($6.28) per share quarterly payout. CMI has a 10-day average volume of around 871,170 shares. Analysts assign a median price target of $256, with a high of $299 and a low of $216, indicating a potential 40% price increase from its current position. Check out that YTD dip in the chart. Buy and hold.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”CMI” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

Plug Power Inc (PLUG)

Plug Power, Inc. (PLUG) is a leading provider of alternative energy technology, specializing in hydrogen and fuel cell systems. PLUG’s solutions are primarily used in the material handling and stationary power markets. PLUG offers fuel cell systems that replace lead-acid batteries in electric vehicles, benefiting distribution and manufacturing companies. Founded on June 27th, 1997, by George McNamee and Larry Garberding, PLUG is headquartered in Latham, NY. PLUG’s stock is down YTD by 28.82%, but it’s showing great promise, and I like it for its upside potential. PLUG has a $4.5 billion market cap and TTM revenue of $770 million at $1.32 per share. Recently exceeding analysts’ MRQ revenue forecast by a modest 1.53%, a win is a win. With a P/B ratio of 1.15x, PLUG has YOY revenue growth (+49.65), EPS (+31.56%) growth—30.89% quarterly growth—and profit margin growth (+11.62%). With a 10-day average trading volume of 24.02 million shares, it’s clear that PLUG’s recent business deals to optimize its impact and effectiveness have popularized the stock. Here’s another great thing: PLUG has a median price target of $15, with a $78 high and a low of $7.50, representing the potential for a 785% price increase from where it sits now. Analysts are on to PLUG, too; Buy and hold.

Interest rates…

Inflation

Banks failing…

The markets are CRAZY right now.

Which is why thousands of investors are flocking into one little-known company.

And if you’re looking for an inflation-beater, you should check it out.

Because this company has just discovered a breakthrough form of energy…

That could very well make it the #1 stock of the decade.

Because this company is about to kickstart what’s called an “energy supercycle.”

And based on early predictions, investors could be looking at 46,700% gains or more.

How’s THAT for beating inflation?

Check out the details here.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”PLUG” start_expanded=”true” display_currency_symbol=”true” api=”yf”]