The year isn’t over, and neither is the chance to make some money! Here are three stocks that could pay out big by the end of the year:

Stock #1: Axcelis Technologies (NASDAQ: ACLS)

This year, the spotlight has been on the semiconductor sector, with investors eagerly eyeing the escalating demand for sophisticated chips essential for data centers powering artificial intelligence (AI) training. For instance, Nvidia’s shares have skyrocketed by 217% in 2023 (to date), a testament to its commanding presence in this niche.

However, the semiconductor realm is vast, suggesting that investors could benefit from scouting for options that aren’t yet on everyone’s radar. One such prospect is Axcelis Technologies (ACLS, down by 0.14%), whose shares have catapulted by 131% this year, aligning with the wider market trends and presenting a more cost-effective alternative to popular giants like Nvidia.

The company recently unveiled its financial outcomes for 2023’s second quarter (concluding on June 30). Surpassing its previous revenue and earnings estimates, Axcelis has elevated its annual projections once more. Here’s why this could be the perfect moment for investors to dive in.

While Axcelis Technologies isn’t directly involved in chip production, it specializes in crafting ion implantation machinery, a key component in chip manufacturing. This equipment is a necessity for semiconductor manufacturers across various segments when they seek to augment production capacity. The clientele of Axcelis extends to makers of advanced logic (CPUs), memory (DRAM), and storage (NAND) chips.

During Q2, Axcelis informed stakeholders of pronounced robustness in the market for silicon carbide power devices. This category encompasses semiconductors for automotive applications, spurred in part by the consumer pivot towards electric vehicles. Silicon carbide is gaining traction as a substitute for conventional silicon-based electronics, given its contributions to enhanced efficiency and compactness.

Uniquely, Axcelis stands as the sole ion implant provider with the expertise to offer comprehensive recipe solutions for every power device application, ensuring clients receive the most efficient setups for mass production.

Additionally, Axcelis reported a burgeoning interest in the AI segment, especially among clients involved in memory chip production. By the end of Q2, Axcelis had accumulated an order backlog exceeding $1.2 billion, indicative of over a year’s worth of revenue awaiting processing.

The company raked in $274 million in the second quarter of 2023. This not only marked a 23.8% ascent from the same timeframe the previous year but also notably surpassed Axcelis’ projected $260 million.

Buoyed by this impressive Q2 performance, Axcelis has revised its 2023 annual revenue estimate upwards by $70 million, reaching $1.1 billion. This revision, the second of its kind this year, would signify a 20% leap from 2022, a year when the market for wafer fabrication equipment is poised to possibly contract by up to 30%. This suggests that Axcelis is capturing market share from rivals, largely owing to the adaptability of its premier Purion platforms.

Furthermore, Axcelis’ earnings per share for Q2 clocked in at $1.86, a staggering 41% surge year over year, also exceeding its earlier predictions. The firm is reaping the rewards of scaling up and judicious cost oversight, leading to a gross profit margin jump to 43.7% in Q2, a substantial increase from 40.9% in the same quarter of the previous year. Consequently, profitability is on the rise.

Considering the company’s trailing 12-month earnings per share of $6.21 and its prevailing stock price of $180, it’s positioned at a price-to-earnings (P/E) ratio of 32. This aligns with the Nasdaq-100’s P/E ratio.

In stark contrast, the leading semiconductor stock, Nvidia, is trading at an elevated P/E of 204. Although Nvidia continues to be the semiconductor industry’s star performer this year, justifying its growth, its steep valuation inherently carries heightened risks, particularly when compared to stocks like Axcelis.

Here’s the clincher: Axcelis’ robust trajectory is probably far from concluding. The company anticipates its revenue swelling to $1.3 billion annually in the next couple of years, propelled by consumer sectors like personal computing and electronics, which are expected to recover from 2024. Moreover, with an extensive order backlog exceeding $1.2 billion, Axcelis is well-poised for sustained business in the foreseeable future.

Stock #2: Brookfield Renewable Partners Inc (NYSE: BEP)

Nuclear power stocks have garnered increasing interest among investors lately. This surge in attention is due to the escalating concerns over climate change, the limitations of solar and wind energy due to storage constraints, the prohibitive expenses associated with hydrogen energy, and the long-standing records affirming the safety of nuclear energy, making this zero-carbon energy source a strong contender.

To put it simply, without getting lost in the scientific weeds, nuclear power primarily involves the process of fission. This process entails breaking apart the nucleus of atoms, which unleashes substantial energy in the form of heat and radiation, thus initiating a continuous chain reaction as long as fuel is available.

The key aspect here is the generation of heat. This heat, produced by fission, warms a coolant—predominantly water—which then turns into steam that drives turbine generators to produce electricity.

The most common fuel for this nuclear fission is uranium-235, an isotope capable of sustaining a fission chain reaction. Extracting this volatile substance from the earth and safely delivering it to consumers is a task that requires specific expertise, meaning only a handful of specialized companies are engaged in uranium mining.

However, mining is merely the initial phase in making the product market-ready. Only a minuscule fraction of naturally occurring uranium is uranium-235. The vast majority, over 99%, is uranium-238, which is incapable of initiating a fission chain reaction and must be converted into uranium-235 through a process called “enrichment.” This sector is quite profitable, dominated by a few companies due to its specialized nature.

Power generation from nuclear energy also necessitates a nuclear power plant, or a reactor. Constructing and maintaining these reactors is a job for a select few companies that possess the necessary technical knowledge and financial backing. Most of these firms are privately held, state-owned, or operate as a subsidiary of a major industrial group. Typically, these companies not only construct the reactors but also provide ongoing maintenance and other essential services throughout the reactor’s operational life.

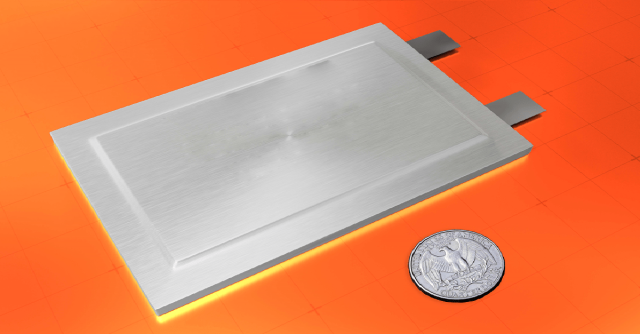

In the past, commercial nuclear reactors were built on a large scale to optimize efficiency because smaller reactors couldn’t match their performance. However, recent technological advancements are making smaller nuclear reactors a more attractive proposition.

Moving past fission, there have been remarkable breakthroughs in nuclear fusion lately. Often referred to as the “ultimate goal” for energy production, fusion is the merging of two light atomic nuclei into a single heavier nucleus, releasing tremendous energy, as defined by the International Atomic Energy Agency.

Fusion’s allure lies in its potential to offer an almost inexhaustible source of clean, secure, and affordable energy to satisfy global energy needs. However, achieving fusion is a monumental challenge, akin to creating tiny stars. The rewards are immense, justifying the years of research and substantial funding it has received. Fusion could become the safest, cleanest form of energy known to man. The lingering question is how much longer it will remain a costly scientific endeavor before transitioning to a commercially feasible option.

Given the immediate need for cleaner energy sources, fusion is gaining favor after years of skepticism, largely due to its environmental credentials and a generally strong safety record, despite a few notable incidents.

So, what’s out top nuclear pick?

Brookfield Renewable currently owns and manages various hydroelectric, wind, solar, and energy storage assets. However, it’s poised to take a controlling interest in Westinghouse, one of the world’s leading nuclear services firms, alongside a consortium of institutional investors.

The acquisition is from Brookfield Business Partners with whom it shares more than just a name. Brookfield Business previously rescued Westinghouse from bankruptcy and is now passing the torch to Brookfield Renewable, a seasoned player in the renewable energy field.

Brookfield Renewable is set to hold a 17% economic stake in Westinghouse, while its institutional allies will possess 34%. This marks Brookfield Renewable’s inaugural venture into nuclear power, though it’s not unfamiliar with expanding into emerging or previously disregarded technologies when profitability is evident. Its history is rich with diversification, from its traditional reliance on hydroelectric power to embracing wind and solar in the mid-2010s and, more recently, energy storage. With nuclear now an option, it’s clear that Brookfield has a robust tradition of pioneering into innovative or revived technologies when the profit potential is clear. This foresight seems to be at play with its Westinghouse investment.

Moreover, it’s not venturing into nuclear territory alone. Cameco is taking the remaining 49% of Westinghouse.

Those investors seeking a more direct investment in nuclear might find Brookfield’s approach conservative, preferring instead a company like NuScale (SMR -4.59%), an emerging business endeavoring to commercialize small-scale reactors.

However, NuScale is in its infancy. It became public through a special purpose acquisition company (SPAC) in May of 2022, and it’s predicted that its inaugural “VOYGR” small modular reactor (SMR) won’t be fully functional in the U.S. until 2030.

Rather than gambling on an untested, futuristic venture, investors keen on capitalizing on the nuclear resurgence may want to turn their attention to established entities like Brookfield Renewable.

Stock #3: C3.ai (NYSE: AI)

C3.ai stands out in the stock market as possibly the most authentic representation of an AI-centric stock, a fact subtly hinted at by the “ai” in both its name and stock ticker. Unlike the other entities mentioned earlier, which are tech conglomerates or semiconductor manufacturers with AI as just a part of their operations, C3.ai dedicates its entire business model to artificial intelligence.

Functioning as a SaaS enterprise, C3.ai provides a platform that enables businesses to implement expansive AI solutions. Through its suite of tools, it assists clients in expediting the software development process, curtailing expenses, and minimizing potential risks. These tools are versatile and find use in an array of applications. For instance, C3 AI Readiness is employed by the U.S. Air Force for anticipatory maintenance, forecasting system breakdowns, streamlining spare part logistics, and enhancing overall mission effectiveness. Similarly, the European energy corporation Engie (ENGIY 0.51%) utilizes C3 AI’s capabilities to scrutinize energy usage patterns and optimize expenditure on energy.

The company is also in the process of unveiling its proprietary generative AI suite, with enterprise search being the initial offering. This search feature enables users to employ conversational language commands to navigate and extract pertinent information scattered across an organization’s various data systems.

As a pioneer in its domain, C3.ai asserts that it doesn’t have a direct rival offering a similar comprehensive enterprise AI development ecosystem. This exclusive niche potentially sets the stage for C3.ai to emerge as a dominant force over an extended period. However, it’s worth noting that the landscape of AI SaaS is dynamic and could possibly draw in formidable contenders from major cloud service providers like Amazon or Microsoft.

Before you consider buying any of the stocks in our reports, you’ll want to see this.

Investing legend, Marc Chaikin just revealed his #1 stock for 2024…

And it’s not in any of our reports.

During his career of nearly 50 years, Marc Chaikin was one of the quantitative minds behind some of the most famous investors in history: Paul Tudor Jones, George Soros, Steve Cohen, and Michael Steinhardt.

Even the Nasdaq hired him to create three new indices.

And now he’s going live with his #1 pick for 2024.

You can learn all about it on Mr. Chaikin’s Website, here.

Wondering what stock he’s investing in?

Click here to watch his presentation, and learn for yourself…

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream… And by then, it could be too late.

Click here to reveal the name and ticker of Marc Chaikin’s no. 1 pick for 2024…