Three Stocks to Avoid Next Week

Seeking out great stocks to buy is important, but many would say it’s even more essential to know which stocks to steer clear of. A losing stock can eat away at your precious long-term returns. So, determining which stocks to trim or eliminate is essential for proper portfolio maintenance.

Even the best gardens need pruning, and our team has spotted a few stocks that seem like prime candidates for selling or avoiding. As interest rates keep rising, the likelihood we see this bear market in tech stocks continue into 2023 increases. With a price more than 70% below its ATH, some may be eyeing our first recommendation of stocks to avoid next week as a bargain, but a closer look reveals several reasons that are not likely the case.

At one point, Meta Platforms (META), formerly Facebook, was one of the very few businesses with a market cap of over a trillion dollars. Due to a host of headwinds, including a macroeconomic downturn, increased competition, lower ad revenues, and post-pandemic normalization of revenue trends, the company’s market cap is a far cry from its $1.07 trillion peak from August 2021. Some may be eyeing META as a bargain currently valued at less than $300 billion. A closer look may persuade anyone on the fence to stay on the sidelines for now.

Meta has seen a lot of changes from what it once was as Facebook. The social media giant’s new vision aims to transform how we connect with its investment in the Metaverse. The company continues to dump billions to bring its Metaverse plans to fruition, but any signs of a near-term payoff are nil. According to management, there is a “long road ahead,” and it will be “years before the metaverse is built.” Therefore, meaningful profit from the new segment is a long way off. Meanwhile, Meta’s core social media business’ daily active users have been growing more slowly, and its advertising business is suffering due to stiff competition.

The company’s Q3 results were mixed as revenue topped expectations but operating income missed, and 2023. Investors were disappointed by the company’s fiscal 2023 operating expense guidance. Management sees opex in the range of $96-101 billion, including an estimated $2 billion in charges related to consolidating its office facilities after it lays off 13% of its workforce. At the midpoint, the company estimates a 13% year-over-year surge in expenses, significantly above Street revenue growth estimates of 7%.

Some adventurous investors may get lucky with well-timed short-term bets on META, as volatility amid tech stocks will likely persist. Still, anyone with a longer-term outlook would do well to wait until there is more certainty for the company.

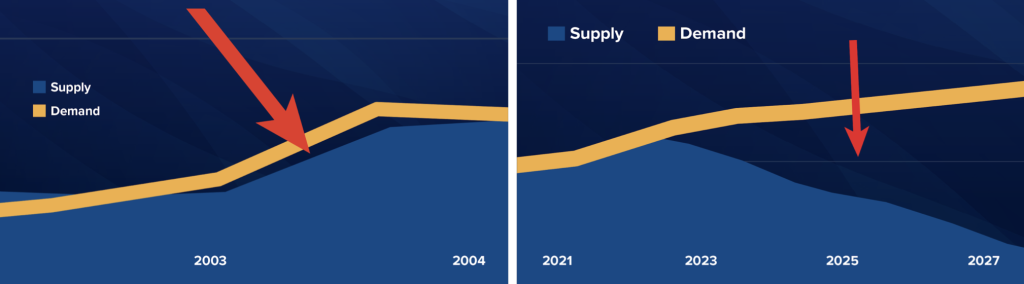

Rising interest rates and a cooling off of the red-hot housing market create a challenging backdrop for mortgage provider Rocket Companies (RKT). Mortgage interest rates have increased about 370 basis points year-to-date, and the average rate for a 30-year mortgage is currently 6.92% versus an average of 3.09% in 2021. Furthermore, the Mortgage Bankers Association recently reported that mortgage application volume is down 37% year-over-year.

Rocket has struggled to meet expectations for the past few quarters as it laps 2021’s blockbuster numbers. Most recently, the company came out with adjusted quarterly earnings of -$0.03 per share, missing the consensus estimate of $0.02 per share. This compares to earnings of $0.46 per share a year ago. Revenue was reported as $1.44B, down nearly 48% from the same period last year and 26% lower than the consensus estimate. Rocket’s been underperforming the broader market so far in 2022. RKT shares have lost about 55% since the beginning of the year versus the S&P 500’s decline of 25%. The pros on Wall Street say to HoldRKT. Of 16 analysts offering recommendations, 2 rate the stock a Buy, 12 rate it a Hold, and 2 say to Sell RKT shares.

Struggling high-end retailer Vera Bradley (VRA) reported lower-than-expected quarterly results last week and lowered 2023 guidance in the face of inflationary and recessionary pressures. The company reported Q2 EPS of $0.08, versus $0.28 from the same period last year. Revenue came in at $130.4 million, missing consensus expectations of $132.51 million.

This isn’t the first rotten quarter for VRA. The designer of high-end handbags, apparel, and luggage has been struggling for some time, missing the consensus mark for earnings and revenue for six of the past seven quarters. According to management, investors should not expect a shift anytime soon. Management sees full-year revenue of $480 – $490 million, less than the $497.56 million that Wall Street expects, indicating the pros could be overestimating the company’s recent performance.

VRA sees 2023 EPS in the ballpark of $0.20 – $0.28, representing a decline of 50% or more from the same period last year’s EPS of $0.57. “We expect the challenging macroeconomic environment to continue for the balance of the year and anticipate it will take additional time to return the Pura Vida e-commerce business to growth, high gas prices and other inflationary pressures will continue to impact the Vera Bradley factory channel, and there will be continued pressure on gross margin. Therefore, we believe it is appropriate to further adjust our outlook for the fiscal year,” CEO Rob Walstrom commented.